Article: published on 29 January 2026

Warning over fake letters claiming to be from banks and HMRC

- Published

Former detective, Rav Wilding

A warning has been issued after customers reported receiving convincing scam letters claiming to be from Nationwide. The letters were designed to look like official bank correspondence and encouraged people to share their personal details after being offered an apparent investment opportunity with a so-called trusted partner.

Former Police officer Rav Wilding joined BBC Morning Live to explain how scammers are turning to old school snail mail to target people through their letterboxes.

The Nationwide scam letters

Customers of Nationwide are being warned to stay alert after reports of convincing scam letters landing on doorsteps. The Building Society confirmed it is aware of fake correspondence circulating after a customer contacted the bank on social media to question a letter they had received. The letter appeared to come from Nationwide and promoted so-called exclusive fixed-rate savings deals, claiming they were offered in partnership with another financial institution.

Rav highlighted how the letters included realistic reference numbers and even quoted the Financial Conduct Authority, making them feel credible. For people who rely on post rather than email, especially those who are digitally excluded, a physical letter can feel more trustworthy. The fact letters cost money to send also leads many people to assume they must be genuine.

Nationwide has confirmed it is aware of the scam and is urging customers to treat any unexpected letters with caution. Its advice:

Always verify messages by calling the number on your bank card, visiting a branch, or logging in via the official website.

Never use the contact details or links provided in a suspicious letter.

HMRC postal scams are also circulating

It is not only banks being targeted. One viewer, Jane, got in touch after her 96-year-old father received a highly convincing letter claiming to be from HMRC. The only incorrect detail was the sort code and account number. He nearly lost £6,000 before the bank identified it as fraud.

Rav says:

"Fake HMRC letters often claim you owe unpaid tax, need to correct an error, or are due a refund which cannot be released without action. The letters usually include your name, address and official-looking reference numbers, sometimes taken from earlier data breaches.

One of the clearest warning signs is how payment is requested. HMRC does not ask for money to be transferred into personal bank accounts and does not demand urgent bank transfers. Messages that create pressure, threaten legal action or impose short deadlines are designed to trigger panic rather than checks."

Timing is often used to add credibility. With the self assessment deadline falling on 31st January 2026, fraudsters know urgency around tax is high and exploit it.

Contact details are another giveaway. Scam letters include phone numbers or web addresses that look legitimate but lead straight to criminals. The safest response is to stop, put the letter down and contact HMRC directly using the details below.

Fighting back against postal scams

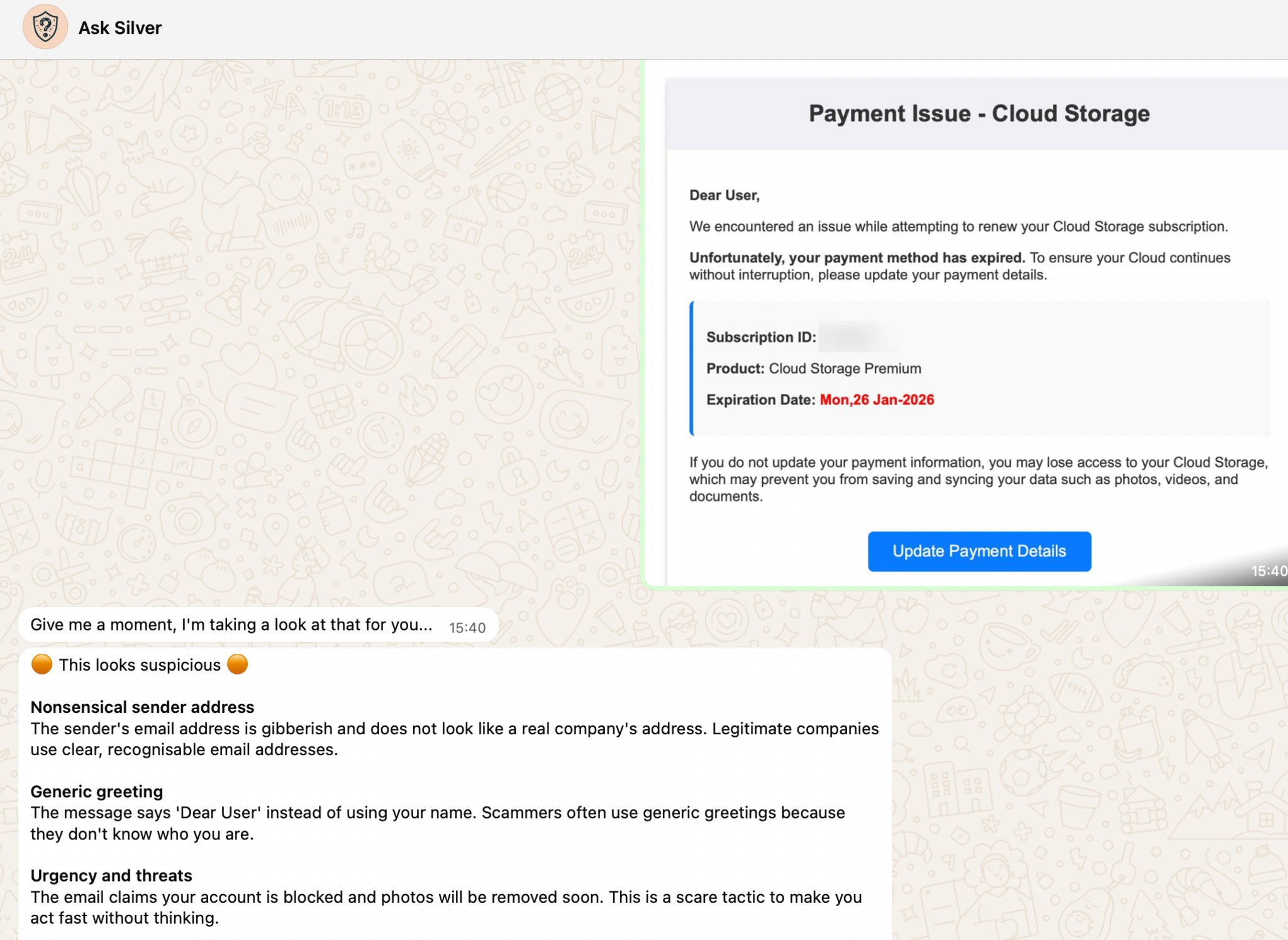

'Ask Silver' scam checking tool allows users to upload suspicious looking emails or text messages, which then analyses the content and highlights common red flags.

There are ways people can take action rather than simply binning scam mail. The Scam Marshal scheme, external, run by Friends Against Scams and supported by National Trading Standards, allows anyone in the UK to send scam letters to investigators using a freepost bag. These real letters help authorities track patterns, understand how scams evolve and disrupt criminal activity.

Some Scam Marshals also share examples with neighbours or local groups to help others spot warning signs. Many say taking part helps rebuild confidence after repeated scam contact.

Another tool available is Ask Silver, external, which helps people sense-check suspicious letters, emails or messages before acting. You can upload an image of a letter or describe what you have received, and the service guides you through simple questions about who sent it, what is being asked, and whether those requests match how legitimate organisations operate.

Ask Silver also highlights common red flags such as pressure to act quickly, unusual payment requests and contact details that do not match official sources. It explains what to do next, whether that means ignoring the letter, reporting it or checking directly with the real organisation using verified contact details.