Inflation rate drops to 3% - what it means for youpublished at 11:23 GMT 18 February

Katie Williams

Katie Williams

Live reporter

Image source, Getty Images

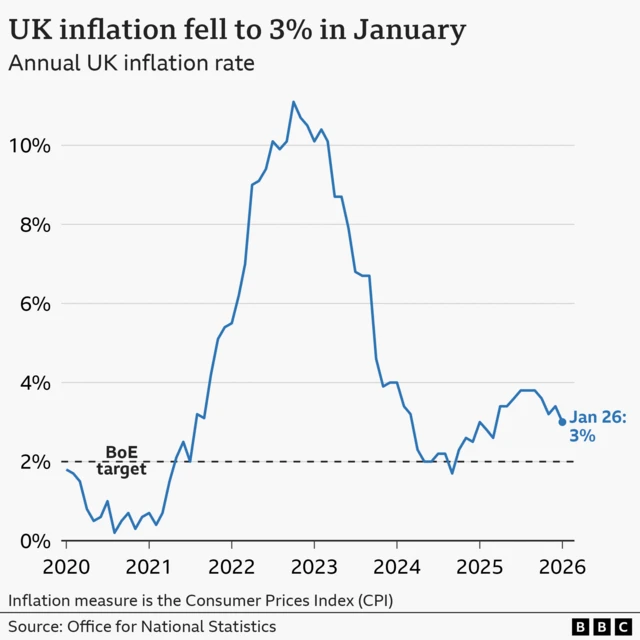

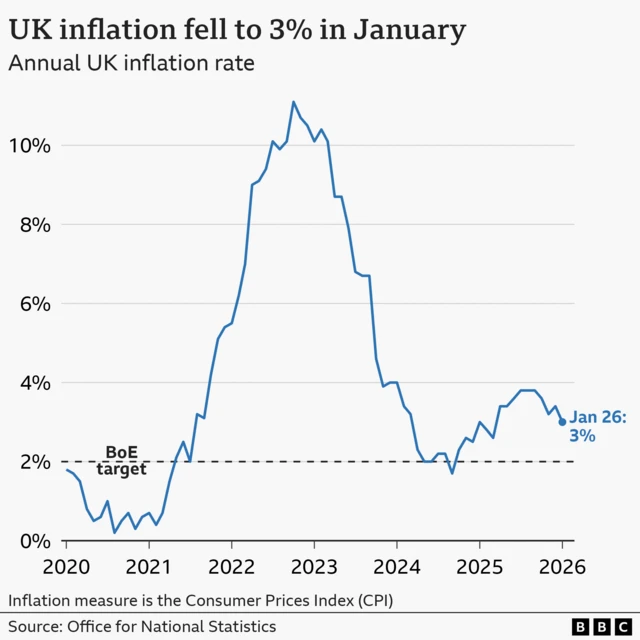

Image source, Getty ImagesThe rate of inflation dropped to 3% in the year to January, down from 3.4% in December, according to the Office for National Statistics (ONS).

What it means: Prices are still rising, just at a slower rate - we've got a brief inflation explainer here.

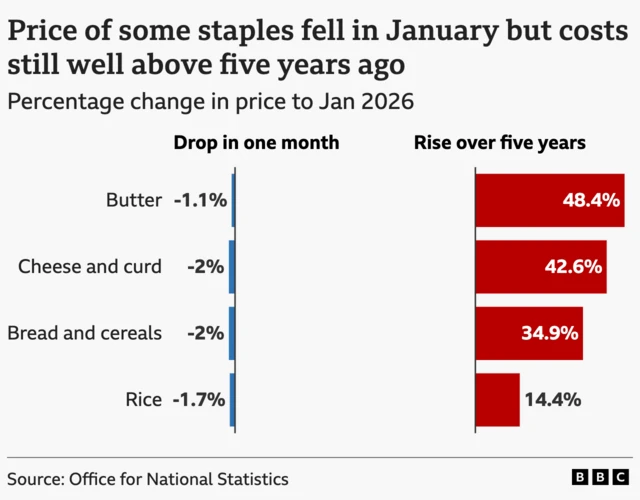

Meat, motor fuels and airfares: These are all items that helped the inflation rate fall, according to the ONS. But the effect was partially offset by the cost of hotel stays and takeaways.

The political reaction: Chancellor Rachel Reeves says "the choices we made at the Budget" are "bringing inflation down", citing policies on energy bills, rail fares and prescription fees. But shadow chancellor Mel Stride says families are "still feeling the pinch because of Labour's economic mismanagement", referencing yesterday's rise in the unemployment rate.

The forecast: The Bank of England said earlier this month it thinks inflation will continue to ease over the coming months, nearing its 2% target in April. Some analysts think today's drop in the inflation rate makes an interest rate cut next month more likely - good news for those with debts and mortgages.

But some are still feeling the pinch: "I heard it announced on the news today, but I haven't felt it," says tea business owner Daniel Graham. He says higher employment costs and Brexit have made it more expensive for him to transport his tea.

We're now bringing our live coverage to a close, but you can read more in our news piece.